Post Office PPF Scheme Invest: For many in India, planning for the future is a deeply personal and family-centered endeavor. It’s about creating a safety net, funding dreams for the next generation, and ensuring peace of mind in later years. Amidst a sea of complex financial options, the Post Office Public Provident Fund (PPF) has remained, for decades, a trusted companion on this journey. It’s not merely a savings account; it’s a long-term partnership built on discipline, security, and the powerful force of time. This article explores how this accessible scheme can help turn steady, manageable savings into a substantial financial resource for life’s most important milestones.

Building a Future, One Deposit at a Time

The essence of the PPF lies in its structure and purpose. Conceived to encourage long-term savings habits, the scheme has a foundational tenure of 15 years. This period isn’t arbitrary; it aligns perfectly with long-range goals like building a retirement corpus or saving for a child’s college education. The true flexibility, however, reveals itself after this period. Account holders can choose to extend their PPF in blocks of five years, indefinitely. This means the instrument can evolve with you, transitioning from a wealth-accumulation tool during your working life to a stable, interest-bearing anchor in your retirement years.

Post Office PPF: Comprehensive Information Table

| Feature | Details |

|---|---|

| Scheme Name | Public Provident Fund (PPF) |

| Managing Authority | Ministry of Finance, Government of India |

| Where to Open | Designated Head Post Offices & Authorized Banks (Public & Private) |

| Tenure | 15 years (Extendable indefinitely in 5-year blocks) |

| Current Interest Rate | 7.1% per annum (Compounded Annually) |

| Interest Calculation | On the lowest balance between 5th and last day of the month |

| Minimum Annual Deposit | ₹500 |

| Maximum Annual Deposit | ₹1.5 Lakh |

| Tax Status | EEE (Exempt-Exempt-Exempt) under Section 80C |

| Partial Withdrawals | Permitted from the 7th financial year onward |

| Loan Facility | Available between the 3rd and 6th financial years |

| Account Holders | Indian residents (Single account per individual, except for minors) |

| Nomination | Available (One or more nominees can be appointed) |

| Transferability | Fully transferable across post offices and authorized banks in India |

The Quiet Power of Compounding Interest

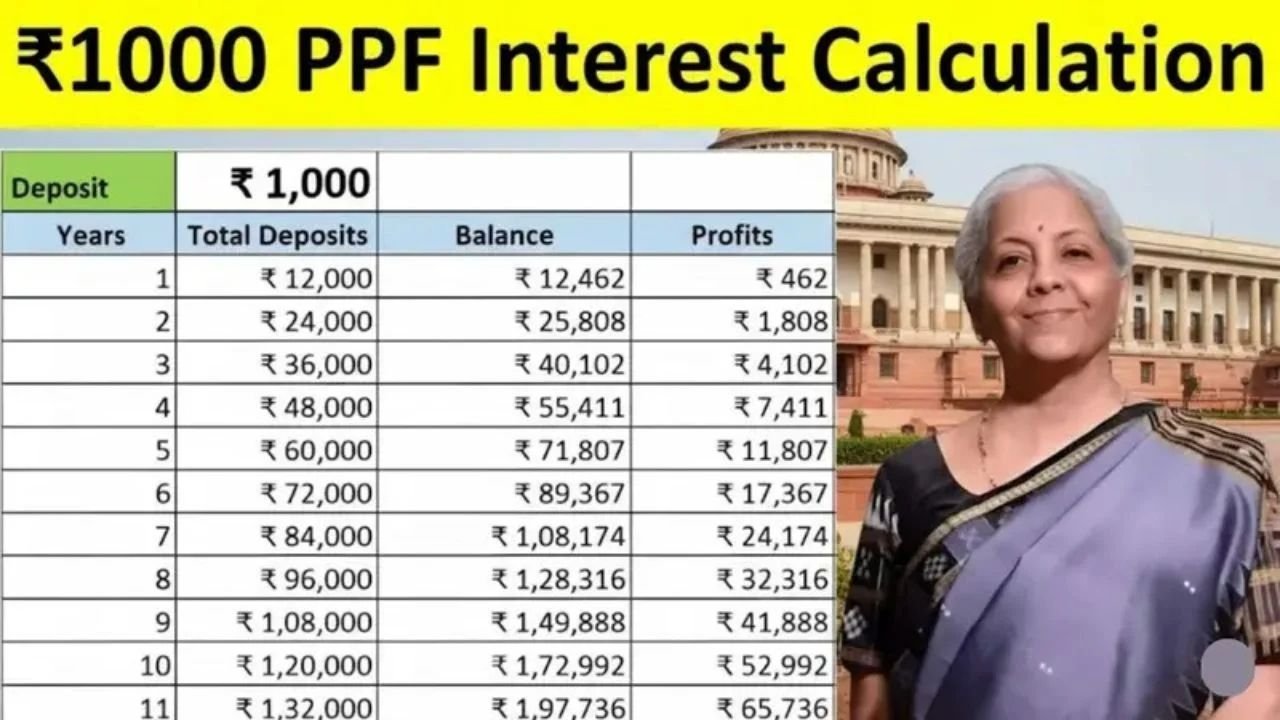

The current annual interest rate for the PPF is 7.1%, compounded yearly. While the rate itself is important, the mechanism of compounding is where the true magic happens. Unlike simple interest, compounding calculates returns on both your original deposits and the interest already earned. Over a decade and a half, this creates a snowball effect. Your savings don’t just grow; they accelerate. This passive, automatic growth transforms regular, disciplined contributions into a significantly larger sum, showcasing how patience and consistency are invaluable assets in wealth creation.

A Framework Designed for Real Life

Understanding that life’s path can be unpredictable, the PPF incorporates thoughtful provisions for accessibility within its long-term framework. After the initial lock-in period, the scheme offers a balance between commitment and liquidity. From the seventh financial year onward, partial withdrawals are permitted annually under specified limits. Furthermore, between the third and sixth years, individuals can take a loan against their PPF balance, providing a financial cushion without breaking the investment cycle. Upon maturity, you have the freedom to either extend the account while continuing contributions or simply let the existing balance continue to earn tax-free interest.

Understanding the Tax Benefits

A standout feature of the PPF is its exceptional tax efficiency, encapsulated in the EEE (Exempt-Exempt-Exempt) status. This three-tiered benefit means that your investment, the interest it earns, and the final maturity amount are all exempt from income tax. Contributions up to ₹1.5 lakh per year qualify for a deduction under Section 80C of the Income Tax Act. Most importantly, the interest that accrues each year and the entire corpus you receive at maturity are completely tax-free. This structure ensures that the returns you project are the returns you ultimately receive, making the effective yield particularly attractive for savers across tax brackets.

Who Can Benefit from This Scheme?

The PPF’s simplicity and security make it a versatile tool for a broad spectrum of individuals. It is an ideal foundation for salaried employees looking to build a retirement fund alongside their EPF. For self-employed professionals and business owners without access to organized pension plans, it provides a structured, long-term savings avenue. Parents seeking a disciplined way to save for a child’s future education or wedding will find its 15-year horizon perfectly suited. Ultimately, it serves any investor who values capital preservation, guaranteed returns, and tax efficiency as much as, or more than, the pursuit of higher, riskier yields.

Frequently Asked Questions (FAQ)

1. Can I open a PPF account online?

While you cannot open a PPF account entirely online as a first-time subscriber, many authorized banks allow you to initiate the application digitally. However, the account activation typically requires an in-person visit for verification. For existing accounts, most banks offer online deposit facilities.

2. What happens to my PPF account if I move to a different city?

One of the strengths of the PPF is its portability. You can seamlessly transfer your account from one post office to another, or from a post office to a bank (and vice versa), anywhere in India. This process is generally free of charge and ensures your savings journey continues uninterrupted.

3. Is there a penalty for not depositing money every year?

Yes. If you fail to deposit the minimum required amount of ₹500 in a financial year, your account will be deemed inactive. To reactivate it, you must pay a penalty of ₹50 for each year of default, along with the minimum deposit of ₹500 for each missed year.

4. How is the interest rate decided, and can it change?

The Government of India reviews and announces the PPF interest rate every quarter. The rate is influenced by broader government bond yields. The rate applicable to your account is the rate announced for the quarter in which your deposit is made. It can change in subsequent quarters.

5. Can a grandparent open a PPF account for a grandchild?

A PPF account can be opened on behalf of a minor only by their natural guardian (parent) or a court-appointed legal guardian. Grandparents cannot open the account directly unless they are legally appointed as guardians.

6. What are my options when my PPF matures after 15 years?

Upon maturity, you have several choices: You can withdraw the entire corpus tax-free. Alternatively, you can extend the account for another 5-year block with or without making further contributions. If you choose not to contribute, the existing balance will continue to earn tax-free interest.

In Conclusion: A Partner in Your Financial Story

The Post Office PPF may not promise overnight riches, but it offers something profoundly valuable in an uncertain world: stability and predictable growth. It stands as a testament to the profound impact of starting early and remaining consistent. In a holistic financial plan, the PPF can serve as the secure, low-risk bedrock—the portion of your portfolio that provides peace of mind. By committing to this disciplined path, you empower the silent, steady forces of time and compounding to build a legacy of security, helping to fund the dreams that matter most to you and your family.